Getting Started

In just a few simple steps, we'll have your new payroll system up and running.

It's as easy as 1-2-3!

Compared to your current costs (including cost for labor), we can provide you with significant savings in your payroll processing. Please contact us for pricing information.

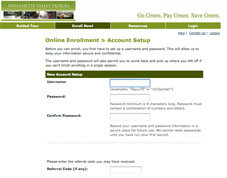

Step 1: Enrollment

- Log in 24/7 from any computer or web-enabled phone.

- Connection is encrypted and secure.

- Process on your schedule, rather than working around ours.

- Our user-friendly interface makes account navigation simple.

Step 2- Enter employee hours and additional earnings

- You control data entry

- No 3rd party data entry errors possible

- Simple to add additional earnings

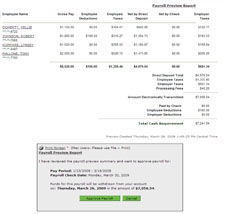

Step 3-Preview and Approve!

- See gross to net breakdown for employees BEFORE approving

- Correct any data entry errors BEFORE payroll is processed

- Verify funds required to cover payroll BEFORE payroll is processed

Once you sign up, payroll is done!

- Employees paid and given paystubs? DONE!

- Federal, state and local taxes deposited and filed? DONE!

- Reports provided? DONE!

- New hires reported to state’s central registry? DONE!

What to Expect once you sign up

- Complete the enrollment agreement today!

- You will receive a phone call within 24 hours from an Online Payroll Specialist to:

- Complete the online enrollment

- Lay the groundwork to run your first payroll with Willamette Valley Payroll

- Please have the following information available for your enrollment call:

- Company’s legal information (Legal business name, federal and state tax account numbers)

- Company’s bank account information for payment of direct deposit and taxes

- Information on earnings and deductions used by company

- Employee information

- Name, address, Social Security number, e-mail address

- Bank account information for direct deposit (ABA Routing number + account number)

- Pay rate

- Information on deductions

- Details on wages paid and taxes withheld for the calendar year to date

- Once online enrollment is complete, an authorized company executive will be asked to review and sign the needed forms

- Return the signed forms and the recent wage detail history to your New Account Specialist

- Your account will be open by 12:00 PM 3 business days prior to your first check date.

- Your New Account Specialist will schedule a time with you to review your account set up data and process your first payroll.

Just $49/Month!

Our payroll system includes:

- Payroll Calculation

- Tax Deposit & Filing

- Quarterly/Annual Filings*

- Direct Deposit**

* W-2 Charges extra

**Up to 5 employees,

unlimited frequency per month